Valuation: A Rule of Thumb

Hello. This is Irino, a strategy consultant.

I will explain tips for evaluating company value.

Table of Contents in Business Plan

|

A very common mistake is to ask for an investment of 1 million dollars and to promise to pay back only 1.05 million dollors a year later. The problem is that you haven’t even try to jump higher than the lowest hurdle: WACC

WACC

= Weighted Average Cost of Capital

= The interest rate your company is fund-raising from shareholders and banks

= The lowest level of profit your company has to earn in order to pay back

= Hurdle rate, often called Discount Rate

If you invest 1 million yen in a project and get 1.05 million yen in return, it is equivalent to a financial product with interest rate of 5%.

The capital cost for most companies exceeds 5 % unless they are listed companies that are highly capable of raising funds with low interest rate. Startup comapnies’ WACC is somewhere between 15 % to 20 %. So, if you propose a business plan lowerer than WACC, it’s like saying “Please invest. This project will lower our company’s value, by the way.” What’s worse is that you will end up with lower than 0 % IRR, because in reality almost all plans underperform initial estimation.

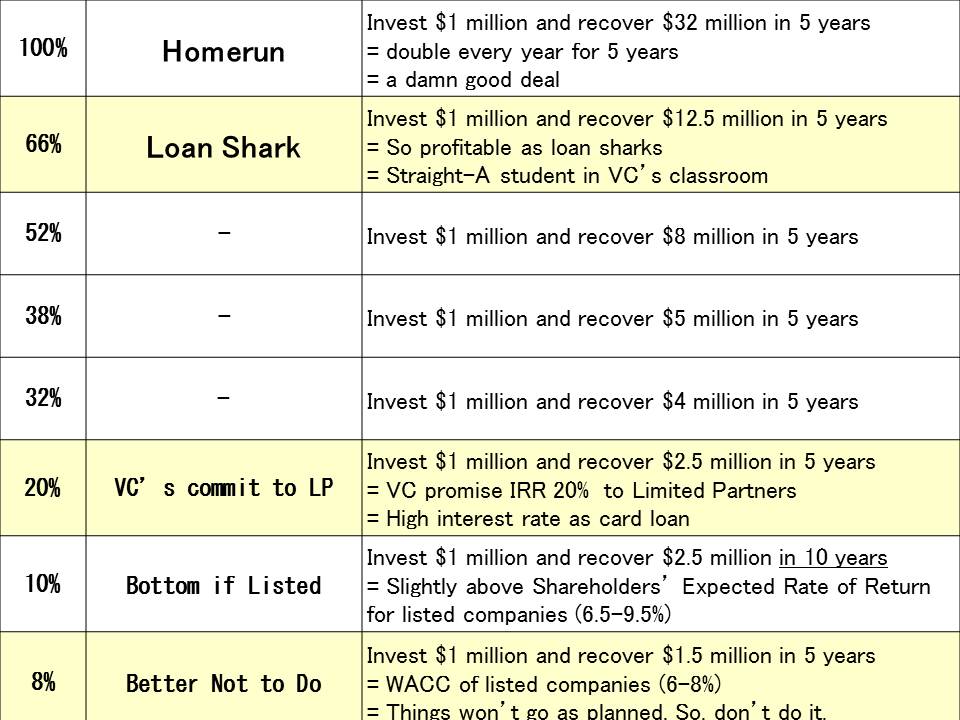

If you don’t have a sense of interest rate, you’ll end up with proposing a return on investment below the lowest hurdle. The table below shows a rough standard of interest rates.

Things don’t go as well as planned. So, you should aim for higher profit level to announce downward revision that is still high enough. In order to achieve higer than 30%, you should aim for as high as 66% Internal Rate of Return. It’s as high as the profit level of loan sharks.

There are many ways to calculate valuation: DCF, EBITDA multiple, PER multiple. None of them are perfect. However, DCF (Discounted Cash Flow)is closest to being perfect, so you would have to calculate using DCF in reality.

How to calculate valuation by DCF is:

Firm Value

= Present Value of N years’ Free Cash Flow

+ Present Value of Terminal Value after Year N.

The first point that beginners often miss is that if the discount rate varies even slightly, the firm value will change drastically. This is well known for intermidiate entrepreneurs.

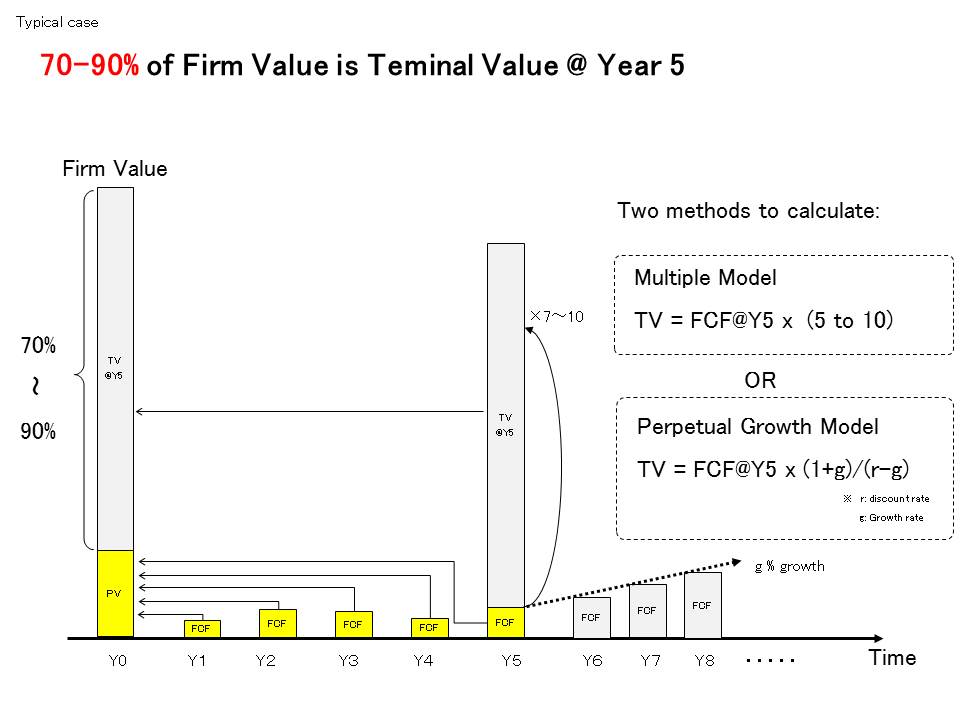

The second point that beginners often miss is that Terminal Value after Year N is overwhelmingly higher than Free Cash Flow during N years. Typically in a 5 year businessplan, Free Cash Flow during 5 years is less than 20 % out of Firm Value. Terminal Value takes up more than 80% of Firm Value

A common mistake is to calculate very precisely on Free Cash Flow during N years, but not so precisely on Terminal Value after Year N. Terminal Values after Year N is determined by Free Cash Flow at Year N: the last year of your business plan. If you look at the calculating formula of Multiple Model and Perpetual Growth Model, you’ll understand that FCF after Year N determines Terminal Value after all.

In Multiple Model:

Terminal Value = FCF at Year N X Multiple

In Perpetual Growth Model:

Terminal Value = FCF at Year N X Multiplying Factor

In Perpetual Growth Model:

Terminal Value

= (FCF at Year N)(1+g)/(1+r) +(FCF at Year N)(1+g)²/(1+r)² + ・・・

= (FCF at Year N) × (1+g)/(r-g)

= (FCF at Year N)× (1+g)/(r-g)

r = Discount Rate

g = Perpetual Growth Rate

Whether Multiple Model or Perpetual Growth Model, FCF at Year N determines your Firm Value for the most part.

(Note)

Instead of FCF at Year N, some people use Terminal Adjusted Free Cash Flow. But Terminal Adjusted Free Cash Flow is calculated based on FCF at Year N after all.

It is paradoxical. 5 years’s FCF which you calculate very earnestly in your business plan is not really so important. But FCF after Year 5 which you do not calculate in your business plan is more important. So, when you calculate Firm Value, a long-term insight on cash flow is more important.

You need speed than precision at the negotiating table for fund-raising. Oral aerial combat without precise Excel calculation often takes place and becomes the base of negotiation.

“Pre-money Equity Value is 5 million dollors. It’s a fair price.”

“Ah, that’s too expensive. You must be kidding!”

Experienced entrepreneurs have their own rule of thumb: a rough method to calculate valuation. An example is “Firm value is 10 times of Free Cash Flow last year.” It is very simplistic, but it’s not necessarily groundless. It can be theoretically explained by the two formulas:

Formula 1:

Terminal Value

=(FCF at Year N)(1+g)/(1+r) +(FCF at Year N)(1+g)²/(1+r)² + ・・・

=(FCF at Year N)× (1+g)/(r-g)

Formula 2:

Firm Value

= Present Value of N years’ Free Cash Flow

+ Present Value of Terminal Value after Year N

Put three premises in the formulas:

Premise 1: N = 0

FCF at Year 0

Present Value of N years’ Free Cash Flow

Present Value of Terminal Value after Year N

Premise 2: g = 0

Perpetual Growth Rate is 0%.

It’s a conservative forecast for a startup company.

Premise 3: r = 10

WACC = 10%.

It’s a little too low for venture-backed companies, but it is average for large corporations.

If you assign these values,

Formula 1:

Terminal Value

= (FCF at Year 0)(1+0%)/(1+10%) +(FCF at Year 0)(1+0%)²/(1+10%)² + ・・・

= (FCF at Year 0)× (1+0%)/(10%-0%)

= (FCF at Year 0) × 10

Formula 2:

Firm Value

= Present Value of 0 years’ Free Cash Flow

+ Present Value of Terminal Value after Year 0

= Terminal Value at Year 0

= (FCF at Year 0) × 10

So, “Firm value is 10 times of Free Cash Flow last year.” has theoretical grounds.

There are other rules of thumb that experienced entrepreneurs often use:

“Firm Value = EBITDA × 6-8”

“Equity Value = Profit after Tax × 15”

Although you should doubt too simplistic rules of thumb, it is important to keep in mind useful and practical ones.

Last week, I helped organize an international conference on rare earth. It was the Japan’s first international conference in the industry. Guest speakers were top executives from foreign mining companies, professors of Tokyo university, and a Nobel Prize candidate. Over 200 industry experts participated despite expensive adminssion fees (800 dollors). It was our honor to host the conference with a great success.

But, just one thing left to be desired was publicity. All major media came to gather information from the conference. NHK TV was there. Asahi newspaper was there. A anchor of World Business Satelite was there. But there wasn’t as much media coverage as I expected.

It was due to the Kabuki actor’s gossip scandal.

The World Business Satelite, the No.1 business news program, prioritized the celebrity scandale over rare earth.

Having blamed the media for a while, however, I realized it was my fault to have less media coverage than expected. There is no point in complaining about the media. That’s the way they are. Don’t try to change them. I should change myself.

A celebrity scandal is easy to attract viewers’ attention, easy to comment about, and easy to fill in long coverage. I should have make it easier for the media by showing them more photogenic scenes of the conference.

Your story needs news value, not economic value. New value means that your story is helpful for the media to attract more viewers for a longer seconds.

That’s it for today. Thanks for reading.

Irino

- One-two finish in the largest business plan contest in Japan

- One-two finish in Asian Entrepreneurship Award

- No.1 in google "business plan"

- Judge in the Cloud-Computing Awards

- Write/Review +100 business plans a year

- Meet +300 entrepreneurs a year

- Large-scale project management

e.g. +15,000 man-months post merger integration - Expertise: business planning, financing, IT, project management

- Fortune Global 500 companies:

bank, brokerage, card, SIer, etc - Startups:

IT, cloud, bio, cosmetics, minor metals, aerospace, etc - Tokyo University -> University of British Columbia -> Oracle -> Headstrong -> Independent