Medium-term management plan

Hello. This is Irino, a strategy consultant.

I am going to describe important points to keep in mind regarding medium-term management plan and also provide you a template for downloading.

What should you write in this section?

- Executive summary

- Background

- Management team

- Company overview

- Management and business principles

- Product/service overview

- How your profits are made ♦♦♦

- Analysis of the market and the competitors

- Marketing and sales strategies

- Operation plans

- Personnel strategies

- Start-up strategies ♦♦♦

- Growth strategies

- Exit strategies

- Financial plans : ♦♦♦

- Risk management

- Project management ♦♦♦

– Sales forecast

– Cost plans

– Financing forecast

– Capital policies

People tend to forget including the following three sections.

7. How your profits are made

12. Start-up strategies

17. Project management

Also, people tend to think that management plan equals numbers and spend too much time and energy on working on Excel calculations for “14. Financial planning”. What matters more is not the numbers, but how these numbers were figured out which is written in other sections.

How long is “medium-term”?

The ideal is 3 years. I would say 5 years is too long. There are a various reasons for this, but the most important of all on the practical level is the calculation logic behind Terminal Value.

A common mistake made when trying to calculate your company value:

Time horizon (n years) for medium-term management plan is too long.

↓

Your prediction of Free Cash flow (n years later) goes wrong.

↓

Your prediction of Terminal value goes even more wrong.

↓

Your prediction of Firm Value also goes substantially wrong.

This is how things will turn out.

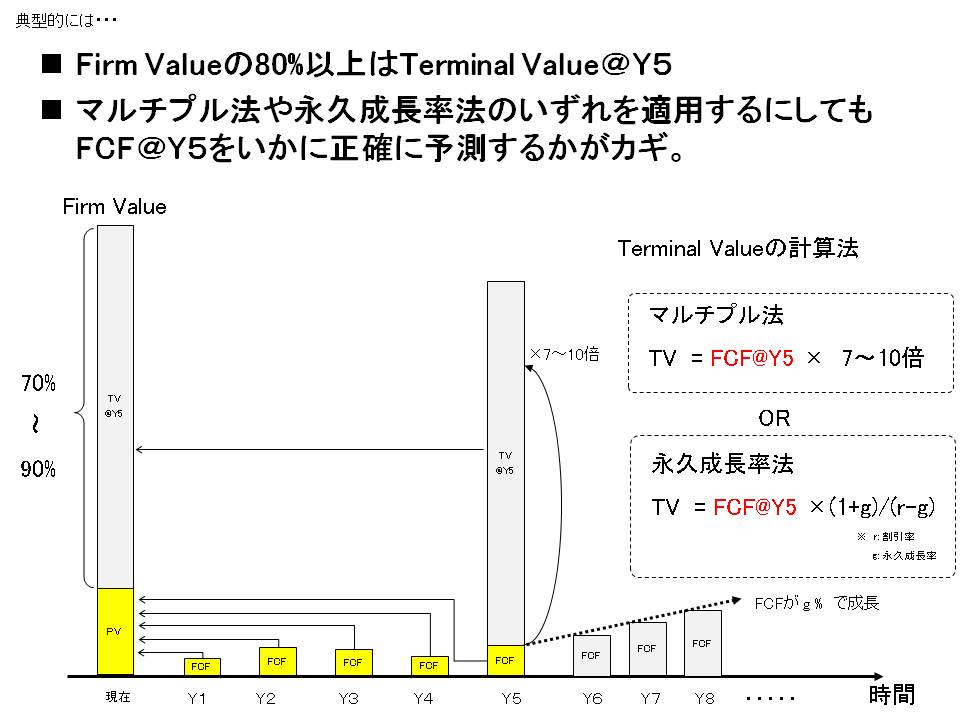

Firm Value ≒ Free Cash Flow in the planned n years + Terminal Value after the year n

In reality, there are many cases in which the percentage of this Free Cash Flow is really small and more than 80% of Firm Values is taken up by Terminal Value. What determines the Terminal Value is virtually, Free Cash Flow at the point of n year. Let’s see Terminal Value from “Multiple” and “Permanent Growth” calculating formula.

Multiple:

Terminal Value = FCF at the point of n year × magnification of multiple

Permanent Growth:

Terminal Value = FCF at the point of n year × (1+g)/(r-g)

Whether you try to apply “Multiple” or “Permanent Growth”, how precisely you predict FCF at the point of n year determines company value for the most part and has a great influence on the accuracy of your management plan. Especially nowadays, interest rates are excessively low and this is causing discount rates to be low as well. This causes

FCF at n year point to be speculated wrongly.

↓

Terminal Value to be speculated wrongly.

↓

Firm Value to be speculated wrongly.

As a result, you need more accurate prediction how things will be at n year.

Therefore, deciding how many years for the n year is really troubling on a practical level. Business environments are changing drastically for all industries, so predicting Free Cash Flow for 5 years later is extremely difficult. Even Free Cash Flow for 3 years later is the limit considering predictability. If economy was growing at a consistent pace, then it might possible to correctly predict how Free Cash Flow will be 3 or 5 years later. However, if the scenario of your management plan is a V-shaped economic recovery, 5 years is simply impossible. you need to consider a W-shaped economic recovery that have both ups and downs too and there is no way you can come up with a logical prediction. I would say 3 years rather than 5 years is the limit rather than appropriate.

That’s it for today.

- A celebrity entrepreneur

- A managing director in a listed company

- A professor

- A rocket scientist

Looking forward to working with excellent leaders.

Please contact:

iphone: 090-6497-4240

irino@linzylinzy.com (Irino)

- One-two finish in the largest business plan contest in Japan

- One-two finish in Asian Entrepreneurship Award

- No.1 in google "business plan"

- Judge in the Cloud-Computing Awards

- Write/Review +100 business plans a year

- Meet +300 entrepreneurs a year

- Large-scale project management

e.g. +15,000 man-months post merger integration - Expertise: business planning, financing, IT, project management

- Fortune Global 500 companies:

bank, brokerage, card, SIer, etc - Startups:

IT, cloud, bio, cosmetics, minor metals, aerospace, etc - Tokyo University -> University of British Columbia -> Oracle -> Headstrong -> Independent